An Overview of Michigan Car Accidents

No-Fault Claims & Bodily Injury Claims

What am I entitled to after getting into a car or trucking accident?

If you were involved in an automobile accident in the state of Michigan, there are two types of claims that may be eligible to pursue – a No-Fault Claim and a Bodily Injury Claim. Let’s discuss both below.

No-Fault Claims

- Also known as a “PIP claim” or a “1st Party Claim”

Who is eligible?

- Almost everyone injured in a motor vehicle accident in the state of Michigan is eligible to received No-Fault benefits.

- You are eligible for No-Fault benefits even if you caused the accident.

- There biggest exception and bar from receiving PIP benefits is if you get into an accident while driving your own uninsured vehicle.

Who pays?

- Your own insurance company (or the highest in priority insurer) is responsible for paying No-Fault benefits. The at-fault driver’s insurance company is not responsible for PIP benefits except in certain very rare situations.

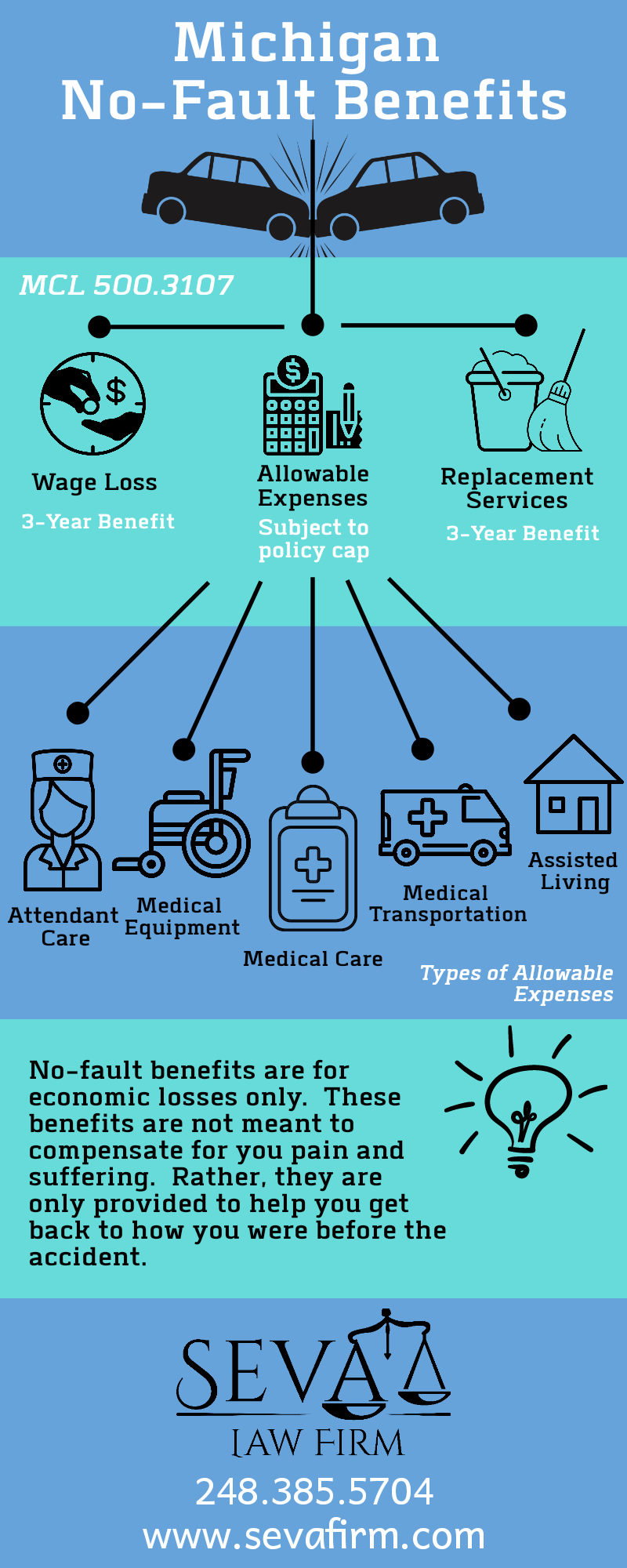

What do I get from a No-Fault claim?

- PIP benefits are “economic” in nature. They are not intended to compensate you for your pain and suffering. Rather, PIP benefits are only intended to get you back to your pre-accident state.

- PIP benefits include medical care, help around the house, and payment of lost wages. A chart of the benefits is displayed below.

What is the maximum I can get?

- Wage loss and replacement services benefits can be collected for up to three years.

- Prior to July 1, 2020, allowable expenses (medical care, attendant care, medical transportation) were unlimited lifetime benefits. After July 1, 2020, you may choose to cap your allowable expenses in exchange for lower premiums.

- If you have chosen a capped No-Fault policy, your auto insurer will no longer pay your medical bills once the policy cap is reached.

How do I file a No-Fault claim?

- To file a No-Fault claim you must notify your insurance company (or the responsible insurer) of the claim within one-year of the accident.

- Navigating PIP claims can be very difficult. We highly advise you to contact us for assistance if you have any questions or concerns. There is no consultation fee. 248-385-5704.

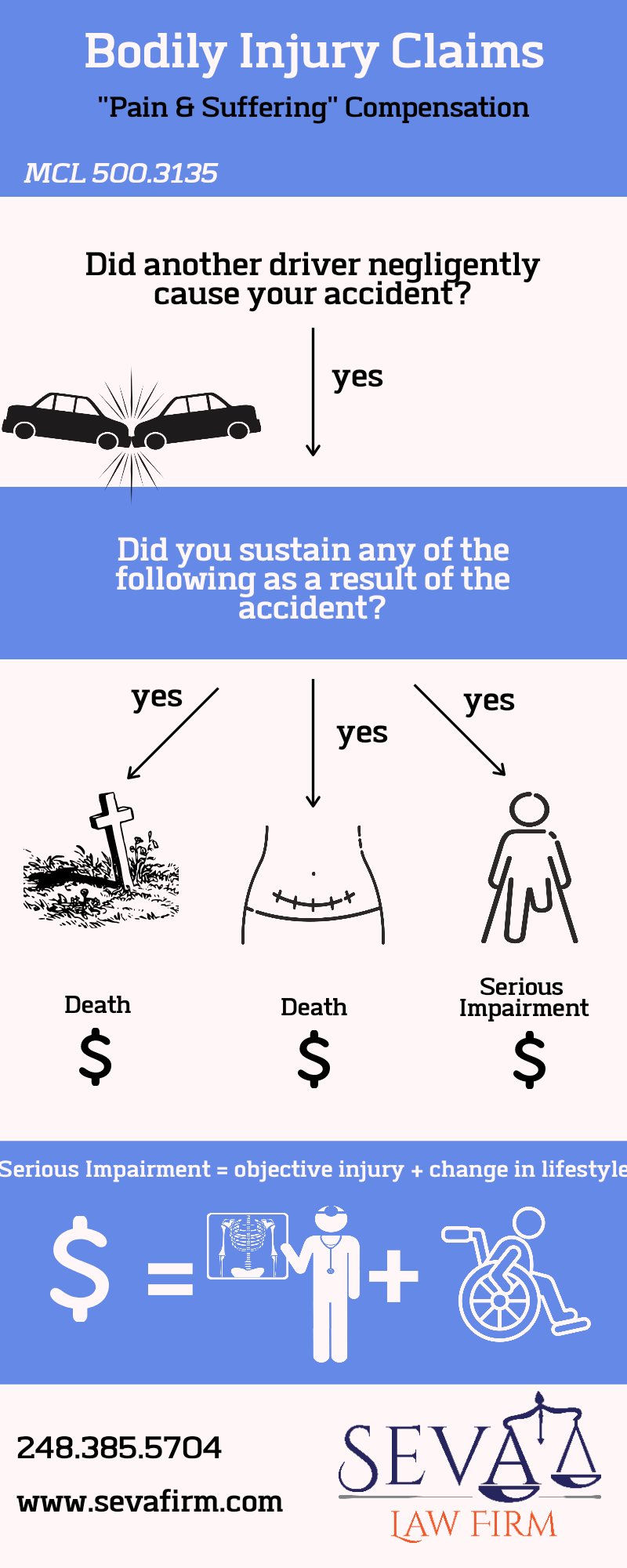

Bodily Injury Claim

- Also known as a “Tort Claim” or a “3rd Party Claim”

Who is eligible?

- You are eligible for a bodily injury claim if you were the victim of auto negligence, i.e. if someone else caused your car accident.

- You must also meet the “tort threshold” for recovery. The tort threshold in Michigan auto accident cases is high. You must be able to prove the accident caused an objectively verified injury that changed your life.

- The infographic below explains how you can become eligible for tort claims.

Who pays?

- The insurer of the at-fault driver is responsible for payment on a bodily injury claim.

- If the at-fault driver did not have insurance and you maintained “uninsured motorist” coverage on your auto insurance policy, then your own insurance company will step in and cover the bodily injury claim.

What do I get for bodily injury claims?

- Third party claims are for compensation for noneconomic damages, i.e. “pain and suffering.”

- Prior to July 1, 2020, bodily injury claims were pure compensation for the injured victim.

- After July 1, 2020, the money paid on bodily injury claims can be liened and taken by medical providers if your No-Fault policy has been exhausted.

What is the maximum I can get?

- Although there is no legal limit on the compensation you can claim in a third party claim, you are artificially limited by the policy limit of the at-fault driver’s bodily injury policy.

- The minimum bodily injury policy in Michigan was increased to $50,000 as of July 1, 2020. This means that if someone has a $50,000 policy, that is typically the most you can obtain.

- If you carry “underinsurance” on your auto insurance policy, you may be able to get additional money from your own insurance carrier after the at-fault driver’s insurance has already paid you their full policy.