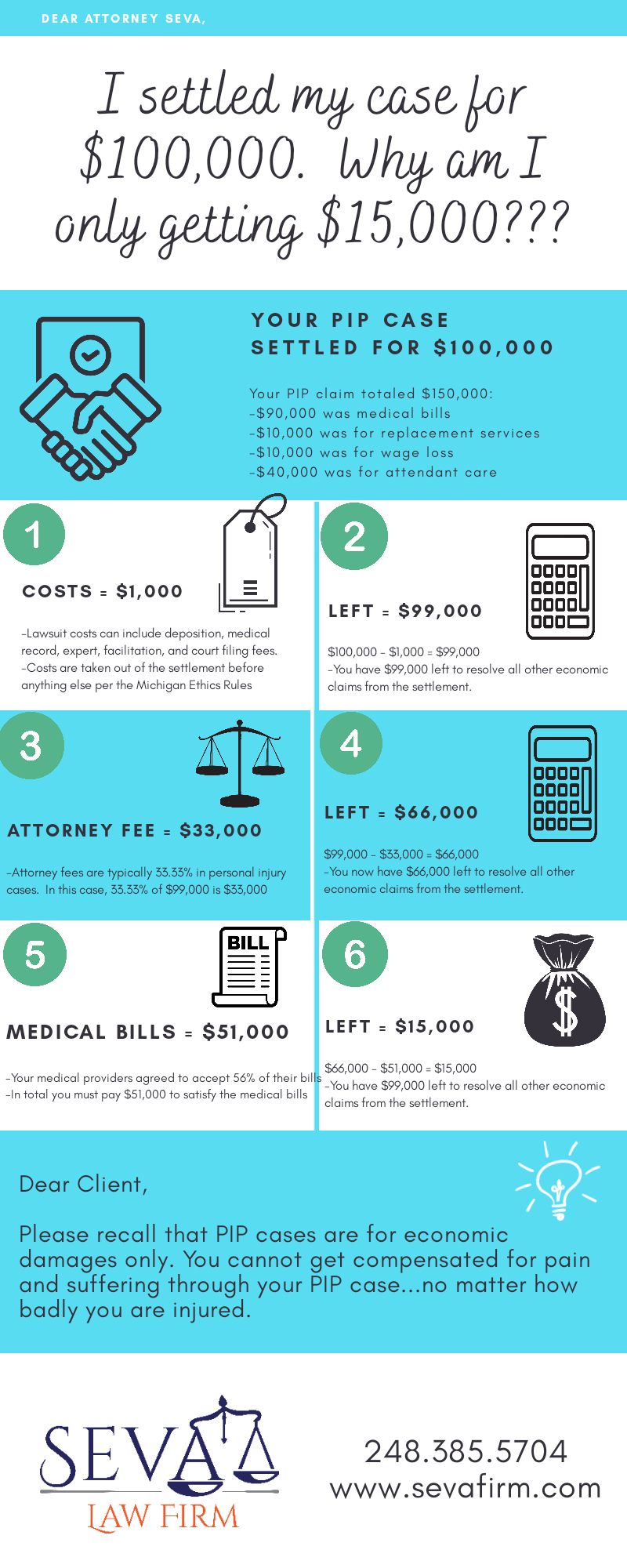

My case settled for $100,000. Why am I only getting $15,000?

Auto Accident Portal

Breaking down a typical PIP case

PIP Settlements in Michigan

The absolute biggest misconception about getting into a car accident (in Michigan at least), is that there is a bag of money waiting for you after an accident. This is simply not true. Michigan laws do not allow for compensation for your “pain and suffering” as a result of an accident. Michigan motor vehicle accident laws were designed solely to help you get healthy and back to being a productive member of society. There is no pot of gold on the other side of the freeway.

A brief history

The No-Fault Act was enacted by the Michigan legislature in 1973 to, essentially, get rid of tort liability and auto accident lawsuits. Before the No-Fault Act was enacted, courts and the legislature grumbled of too many lawsuits arising from car accidents. There was also discontent among hospitals and medical providers as their accident related medical bills would often not get paid.

One big reason for this was because under the old tort system a car insurance company did not have to pay a medical bill unless the injured person could prove that someone else was at fault for the accident. This automatically disqualified half the people injured in auto accidents (those who were at-fault or in single vehicle accidents) from getting medical coverage through the auto insurer. Those people would have to seek coverage through their health insurers. In 1973, not many Michiganders had health insurance for non-hospital care. This left many people unable to get medical care. It also left many medical providers without payment for their services.

To address these issues, the Michigan legislature passed the Michigan No-Fault Act, (MCL 500.3100 etc. seq.). The No-Fault Act was designed with the following goals:

- To ensure everyone injured in an accident can get medical care and can get reimbursed for economic losses arising from the accident;

- To ensure hospitals and medical providers get reasonable payments for treating automobile accident patients; and

- To reduce the number of lawsuits filed as a result of car accidents.

What the No-Fault Act was NOT meant to do, however, was to allow for compensation for “pain and suffering” as a result of an accident. The No-Fault Act was not, and is still not, intended to compensate most accident victims. There is an exception if your injuries are extremely serious, i.e. if you sustained a “serious impairment of a body function” or a “permanent serious disfigurement.”

Most PIP Settlements are for Medical Bills

Now that you have an understanding of what No-Fault insurance is and what it is intended to cover, the above infographic example may make slightly more sense. Notwithstanding, you are still probably somewhat confused at how the client ends up with $15,000 on a $100,000 settlement. Let’s take a closer look at our example with some added information:

- You were in a car accident on January 1, 2018.

- You sustained back injuries that required physical therapy and pain management.

- Your car insurance company paid for the physical therapy and pain management for six-months.

- The insurance company then decided to send you to an “independent medical examination,” i.e., a doctor hired by the insurance company to evaluate you. The insurance company doctor reports that you have reached your maximum medical improvement and you do not need any more accident-related treatment.

- Since the insurance company doctor reported you do not need any more medical treatment, the insurance company told you that it is not going to pay any more medical bills after August 1, 2018.

- Unfortunately, you were still in a ton of pain at that point and still needed more pain management treatment.

- Your doctors and therapists advised you that you could continue to see them as long as you pay their bills through a PIP lawsuit against the insurance company. Accordingly, you continued to treat for several more months.

- You then hired an attorney (hopefully the Seva Law Firm) and filed a lawsuit against the insurance company.

- The lawsuit proceeded for 9-months through discovery and case evaluation.

- We are now at a facilitation where you and the insurance company meet with your respective attorneys to try and settle the case.

- At this point, you have to pay the following bills from your lawsuit:

- Physical therapy – $30,000

- Pain management – $30,000

- Image center – $10,000

- Surgical center – $20,000

The total medical bills are at $90,000

- You also still have $10,000 in wage loss as well as $10,000 in replacement services, and $40,000 in attendant care provided by a family member.

- In total, there is $150,000 that must be claimed in the PIP suit.

- The insurance company starts negotiating by arguing that all of your treatment after August 1, 2018 was unnecessary or unrelated to the auto accident. Further, you were fine to go to work and didn’t need any replacement services. The insurance company initially offers $30,000 to settle the $150,000 claim.

- After a few hours of negotiating, the insurance company comes up significantly from their initial offer. However, the facilitator makes it clear that the insurance company’s final offer is for $85,000 because they think they can win at trial.

- You tell the facilitator that you are not going below $120,000 because you think you can win at trial.

- Ultimately, both sides compromise and settle the case for $100,000 after your attorney gets the medical providers to compromise their bills to 56% of what was billed.

So now, we have a settlement of $100,000…but you need to pay $150,000 in claims. You also need to pay a one-third contingency attorney fee and $1,000 costs (filing, deposition, and facilitation fees). How does this work?

Well first, the costs must come off the top of the settlement. So we start by subtracting $1,000 from the $100,000 settlement, which leaves us with $99,000. After this, the one-third contingency fee ($33,000) must be subtracted. This leaves us with $66,000. From this, we must pay the medical providers. They agreed to 56% of what they billed, which is $51,000 in total. Subtracting $51,000 from the $66,000 we had leaves $15,000 for the replacement services, attendant care, and wage loss that is owed.

The $15,000 that is leftover is yours. You can use that to pay your care providers or do what you want with that money. That is entirely up to you.

Not fair. Or is it?

You must be thinking that this settlement breakdown is not fair. It is not fair you only got $15,000 when you had $60,000 in wage loss, replacement services, and attendant care. It is not fair that the doctors got $51,000 when you only got $15,000. That the lawyers got $33,000 when you only got $15,000. After all, you were the one who got hurt, not the doctors and lawyers.

There is definitely some merit to your frustration. You have a right to be annoyed that you struggled through more than a year of pain, anxiety, and hassle for only $15,000. However, getting $15,000 in this situation is actually very fair. Here is why:

First, this case was litigated through a lawsuit for an important reason – the insurance company did not want to pay anything. The fact that you were able to get the insurance company to come up from $0.00 to $100,000 is a major win. Second, recall from above that the No-Fault Act was designed to get you back to health and not to compensate you. The settlement achieves that.

Third, yes, the doctors got more than you. But, you also received significant services from them. Medical care is not cheap and they were willing to accept a discounted rate and also treat you without payment for months. You basically got medical treatment on sale. Finally, your attorney also got more than you. Like with the doctors, you received significant services from the attorney. In fact, if not for the attorney you wouldn’t have seen a penny. The one-third contingency fee is standard for personal injury attorneys and is money well-spent to obtain a reasonable result.

Conclusion

It can be shocking and seemingly unfair when you learn that you are only receiving a fraction of your PIP settlement. However, when determining whether the settlement is reasonable – whether it is “good” – you need to take into consideration what PIP cases are meant for. They are meant to get your medical bills paid, get your lost wages paid, and get your helpers at home some money for their efforts. If the insurance company has a strong defense (even if they are wrong) and you are still able to get a significant portion of the PIP claims paid, then you have obtained a reasonable settlement.

In other words, measure the success of a PIP case by whether you returned to your pre-accident life and not by the amount of money you receive. Looking at the money will only leave you disappointed.